Understanding the Psychology Behind Your Spending Habits

Have you ever wondered why you spend money the way you do? Do you find yourself making impulsive purchases or constantly splurging on items you don’t really need? Understanding the psychology behind your spending habits can give you a deeper insight into your behaviors and help you make better financial decisions.

The Science of Spending

There is a lot more to our spending habits than just simple desires or wants. The truth is, spending money is a highly psychological process that is influenced by a variety of factors such as our emotions, past experiences, and societal norms. To truly understand why we spend the way we do, we need to delve into the science behind it.

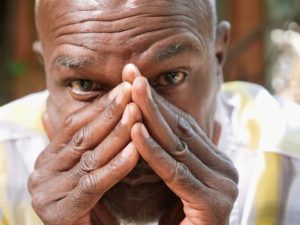

The Role of Emotions

It’s no secret that our emotions play a significant role in our spending habits. Whether we realize it or not, our emotional state can greatly influence our decisions to buy things. For example, when we are feeling stressed or down, we may resort to retail therapy as a means of temporarily boosting our mood.

On the other hand, positive emotions such as happiness or excitement can also lead us to spend money. We may feel the need to treat ourselves or reward ourselves for our accomplishments. Advertisers are well aware of the impact of emotions on our spending habits and often use emotional appeals in their marketing strategies to entice us to buy their products.

Our Past Experiences

Our past experiences can also shape our spending behaviors. If we grew up in a household where money was freely spent without much thought, we may adopt the same habits in adulthood. Likewise, if we have had negative experiences with money or have struggled with financial stability, we may develop a more frugal mindset.

Our upbringing and early experiences with money can create deep-rooted beliefs and attitudes towards spending that can be hard to break. For example, someone who grew up with a scarcity mindset may constantly feel the need to purchase things out of fear that they may not have enough in the future.

Social Influences

The society we live in also has a significant impact on our spending habits. We are bombarded with advertisements and societal pressures to buy certain products in order to fit in or meet the expectations of others. This can lead to the phenomenon of ‘keeping up with the Joneses,’ where we feel the need to spend money on material possessions to keep up with our peers or maintain a certain social status.

The rise of social media has only amplified this effect, with influencers and celebrities showcasing their luxurious lifestyles, making us feel like we need to spend money to keep up appearances.

Breaking the Cycle

Understanding the psychology behind our spending habits is the first step towards making positive changes. By recognizing the factors that influence our decisions to spend, we can begin to take control of our behaviors and make more conscious choices when it comes to our finances.

Here are a few tips to help you break the cycle of unhealthy spending:

1. Identify Your Triggers

Take some time to reflect on your past spending experiences and try to identify any patterns or triggers that lead you to make impulsive purchases. Maybe you tend to shop when you’re feeling stressed or when you see a sale sign. Once you know your triggers, you can work on finding healthier ways to cope with your emotions or avoid situations that may tempt you to spend unnecessarily.

2. Plan and Budget

Creating a budget can be a great tool to help you manage your spending. Write down your monthly expenses and allocate a certain amount for discretionary spending. This will give you a clear picture of where your money is going and help you make more intentional purchases.

3. Practice Gratitude

Gratitude has been proven to have a positive impact on our well-being and our finances. Instead of focusing on what you don’t have, try to appreciate what you do have. This can help you shift your mindset from constant spending to being content with what you already have.

4. Delay Gratification

Impulsive buying is often a result of seeking immediate gratification. Instead of giving in to the urge to buy something right away, practice delaying your purchase. Take a day or two to think about whether you really want or need the item. This will help you make more rational decisions and prevent buyer’s remorse.

Conclusion

Our spending habits are deeply ingrained in our psyche and can be hard to change. However, by understanding the psychology behind our behaviors, we can gain more control over how we spend our money. Remember, spending is not always a bad thing. It’s about finding the balance between treating ourselves and being responsible with our finances. By being more mindful of our spending, we can work towards creating a healthier relationship with money.